When it comes to gambling, whether in a physical casino or online, one question that often comes up is whether or not you have to pay taxes on your winnings. The answer to this question can vary depending on where you live and the specific laws in your country or jurisdiction. In this article, we will explore the gambling tax laws in various countries and provide insights into whether or not you may be required to pay taxes on your gambling winnings.

United States

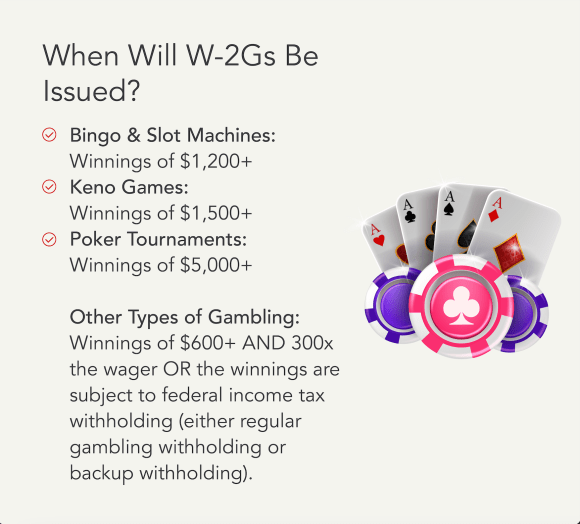

In the United States, gambling winnings are considered taxable income and must be reported on your federal income tax return. This includes winnings from casinos, lotteries, and any other form of gambling. You are required to report all gambling winnings, regardless of the amount. The IRS also requires you to keep a record of your winnings and losses, including receipts, tickets, and other documentation.

Depending on the amount of your winnings, you may also be required to pay estimated taxes on your gambling income. If you win more than $5,000 in a single session, the casino or gambling establishment may also withhold a portion of your winnings for tax purposes.

United Kingdom

In the United Kingdom, gambling winnings are not subject to income tax. This includes winnings from casinos, sports betting, lotteries, and any other form of gambling. The UK government does not consider gambling to be a source of income, so you do not have to pay taxes on your winnings.

However, if you are a professional gambler or if gambling is your primary source of income, you may be required to pay taxes on your winnings. In that case, you would need to report your gambling income on your tax return and pay taxes on any profits you make.

Australia

In Australia, gambling winnings are not considered taxable income. This includes winnings from casinos, lotteries, sports betting, and any other form of gambling. The Australian government does not tax gambling winnings, so you do not have to pay taxes on your winnings. However, if you are a professional gambler or if gambling is your primary source of income, you may be required to pay taxes on your winnings.

It is important to note that tax laws can vary from country to country and even from state to state within a country. If you are unsure about the tax laws in your area or if you have any questions about whether or not you need to pay taxes on your gambling winnings, it is always a good idea to consult with a tax professional or accountant.

Conclusion

When it comes to gambling tax laws, the rules can vary depending on where you are located and the specific laws in your area. In general, most countries do not tax gambling winnings, but there are exceptions for professional gamblers or those who rely on gambling as their primary source of income.

If you have questions about whether or not you need to pay taxes on your gambling winnings, it is best to consult with a tax professional who can provide you with guidance based on your individual situation. Remember to keep accurate records of your winnings and losses, as this will help you stay in compliance with tax laws and avoid any potential penalties or fines.

Overall, it is important to understand the tax laws in your area and ensure that you are complying with any requirements related to gambling winnings. By staying informed and seeking professional advice when needed, you can enjoy your gambling activities with peace of mind knowing that you are following the law.